reit tax benefits uk

The governments current consultation due to close on 20 May on the benefits of an online sales tax to relieve pressure on business rates arose following calls from the retail and rating industry for a fairer tax system. Moneyfactscouk Limited is registered in England and Wales company no.

How To Invest In Reits In The Uk Ig Uk

The REIT has announced a distribution of Rs 2734 crore that works out to Rs 461 per unit for the quarter taking its distribution for the financial to Rs 184 per unit.

. Tritax Big Box REIT. REITs reach 41 of Global listed real estate at 13tn USD and UK. 11 How many income tax treaties are currently in force in your jurisdiction.

The Company seeks to provide investors with an attractive level of income and the potential for capital growth becoming the REIT of choice for private and institutional investors seeking high and stable. For general enquiries or status updates on applications contact us by. With so many REITs available to UK investors finding one that suits your long-term investing goals can be difficult.

A real estate investment trust REIT is a company that owns and in most cases operates income-producing real estateREITs own many types of commercial real estate including office and apartment buildings warehouses hospitals shopping centers hotels and commercial forestsSome REITs engage in financing real estate. Dividend which is tax-exempt in the hand of unitholders forms around 933 or Rs 430 per unit portion of distribution while interest constitutes the remaining 67 or Rs 0. The survey is updated annually.

The rate in column 2 applies to dividends paid by a RIC or a real estate investment trust REIT. The ongoing benefits of REIT status together with. SPDR Dow Jones REIT ETF.

44 0 3000 547584. How to invest with a real estate investment trust REIT Structured deposits explained. However Nigeria currently has only 16 DTTs in force for taxes on income corporations petroleum revenue and capital gains amongst others of a similar character with the following countries.

Sabra Health Care REIT. The tax advantage of not being required to account for withholding tax is not one of the main benefits of the arrangements therefore s3061c Finance Act 2004 is not satisfied and the. The REIT structure varies country-by-country and it is constantly evolving.

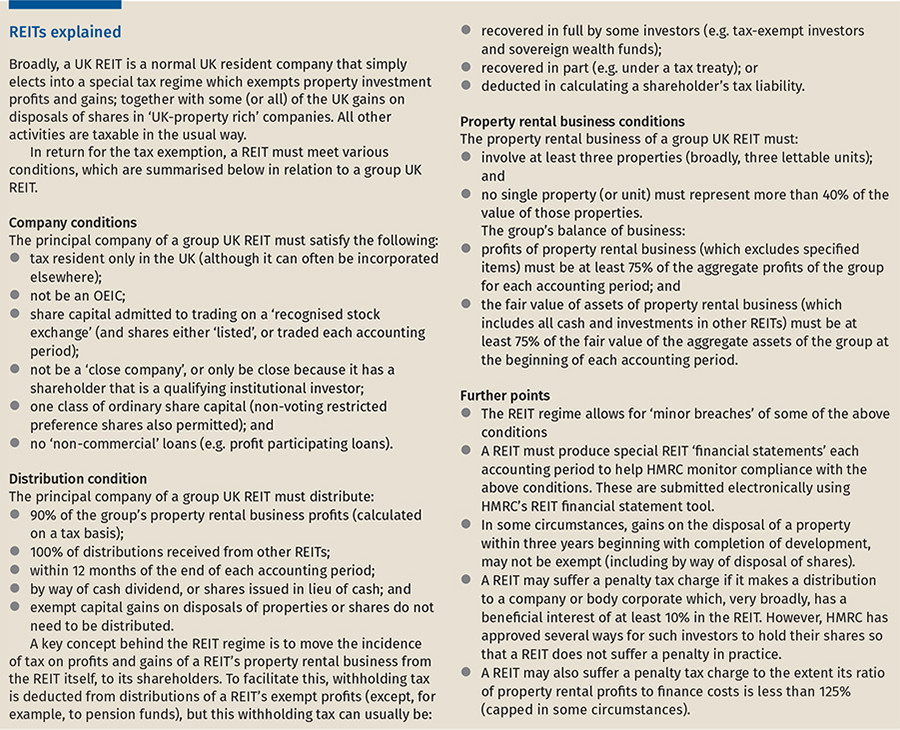

03000 547 584 If youre phoning from outside the UK. The UK Real Estate Investment Trust REIT regime launched on 1 January 2007 immediately saw a number of the UKs largest listed property companies convert to REITs. REIT ETFs provide a reliable stream of passive income for dividend investors without the hassle of owning or managing a property.

Discover in this short video below the role and benefits of REITs. Multifamily housing manufactured housing single-family rental housing or senior housing. One of the most popular reasons to start a REIT is the tax benefits.

An asset may include tangible property a car a business or intangible property such as shares. Here is a list of the most popular UK REITs for 2022. John Webber - Director and Head of Rating High-street retailers demand a.

Moneyfacts House 66-70 Thorpe Road Norwich NR1 1BJ. However that rate applies to dividends paid by a REIT only if the beneficial owner of the dividends is an individual holding less than a 10 interest 25 in. 33 1 5643 3323 Tel33 1 5643 3313.

REIT holdings must generate at least 75 of its revenue from the following categories of prosperity. Those on a low income or receiving certain benefits may be able to claim Council Tax Support. IShares UK Property UCITS ETF.

The upcoming dual-branded hotel will include two hotels - a Hilton Hotels Resorts brand hotel and a Hilton Garden Inn brand hotel and will come up in Embassy Tech Village ETV owned. Embassy Office Parks REIT and global hospitality company Hilton have entered into a partnership to develop over-500 key hotels in Bengaluru with an investment of Rs 850 crore. Most countries laws on REITs entitle a.

Custodian REIT offers investors the opportunity to access a diversified portfolio of UK commercial real estate through a closed-ended fund. David Giraud Chief Executive Officer Khalil Hankach Chief Financial Officer Inovalis Real Estate Investment Trust Inovalis Real Estate Investment Trust Tel. Benefits and disadvantages of investing in REIT ETFs.

Download Latest Reports. A capital gain is only possible when the selling price of the asset is greater than the original purchase price. A REIT isnt usually taxed on the trust level.

Nigeria is party to 24 Double Tax Treaties DTTs. Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. Instead the investors are taxed on their dividends.

Since then the regime has continued to evolve with a number of developments. Download the Global REIT Survey 2021.

Reits Vs Real Estate Mutual Funds What S The Difference

You Can Learn New Ways To Increase The Profitability Your Property Investments By Checking Out Our Real Estate Investment Trust Real Estate Investing Investing

What Is An Reit And Is It A Good Investment

Taxation Of Reits Ringing In The Changes

Reit Might Sound Intimidating At First But It S Really A Very Simple Concept Think Of It As A Mutual Fu Investing Money Strategy Investing Money

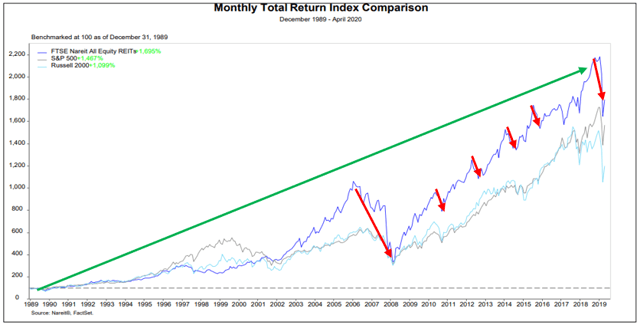

Why Reits Will Fail You Seeking Alpha

What Are The Best Reits To Invest In United Kingdom Investing Strategy Safe Investments Marketing Jobs

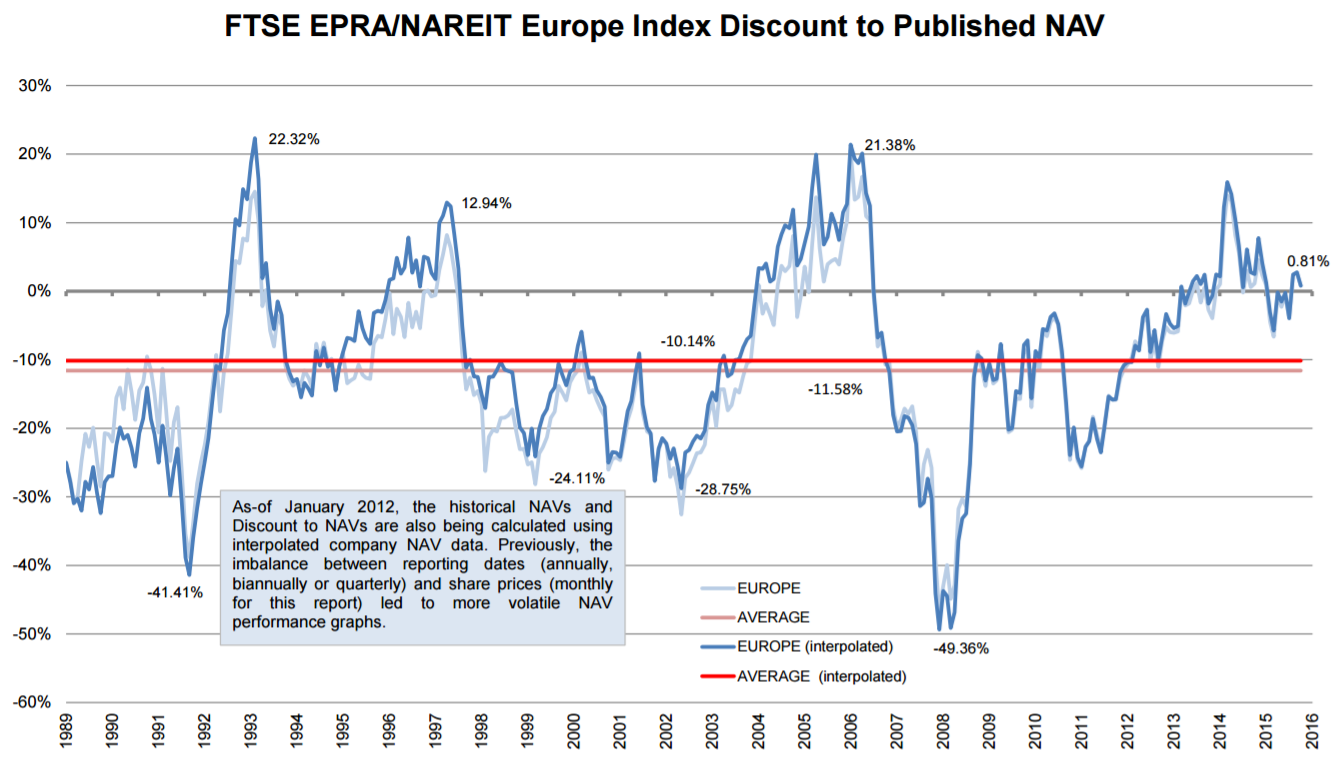

My 3 European Reit Picks Otcmkts Btlcy Seeking Alpha

Reits A Force For Good Crestbridge

What I Wish I Knew Before Investing In Reits Seeking Alpha

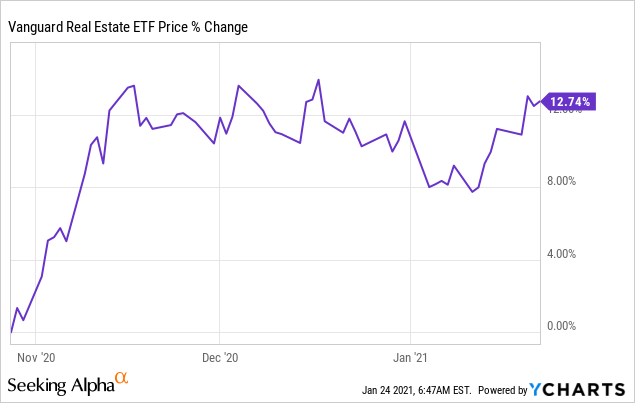

Are Reits Still A Good Investment Seeking Alpha

The Most Important Metrics For Reit Investing Intelligent Income By Simply Safe Dividends

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Reit Dividends And Uk Tax Assura

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Section 162 Executive Bonus Plan And It S Benefits How To Plan Life Insurance Policy Permanent Life Insurance

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)